Contribution Limit Hsa 2025

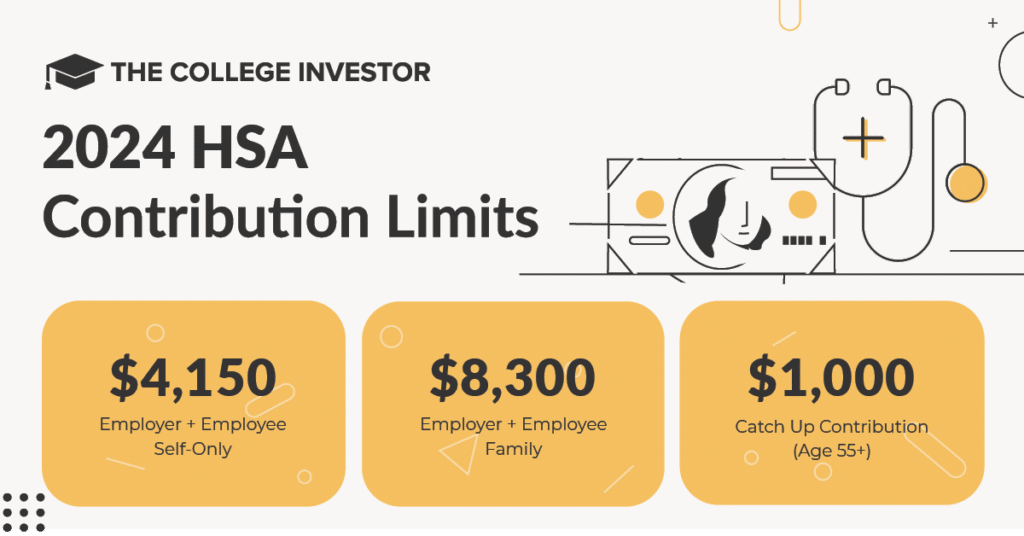

Contribution Limit Hsa 2025. Employees will be permitted to contribute up to $4,150 to an individual health savings account for 2025, the irs said tuesday. Hsa regular contribution limits for 2025:

The 2025 hsa contribution limit for families is $8,300, a 7.1% increase from the 2025 limit of $7,750. Hsa regular contribution limits for 2025:

The maximum amount of money you can put in an hsa in 2025 will be $4,150 for individuals and $8,300 for families.

2025 Hsa Limits Irs Letty Olympie, For family coverage, the hsa contribution limit jumps to $8,300, up 7.1 percent from $7,750 in 2025. Hsa members can contribute up to the annual maximum amount that is set by the irs.

The Best Order of Operations For Saving For Retirement, You can contribute up to $8,300 to a family hsa for 2025, up from. Annual hsa contribution for participants aged 55 and older :

What Is The Minimum Deductible For An Hsa 2025 Candi Corissa, The maximum contribution for family coverage is $8,300. That limit increases to $7,750 if you.

Hsa 2025 Family Limit Ciel Melina, For 2025, individuals under a high deductible health plan (hdhp) have an hsa annual contribution limit of $4,150. (people 55 and older can stash away an.

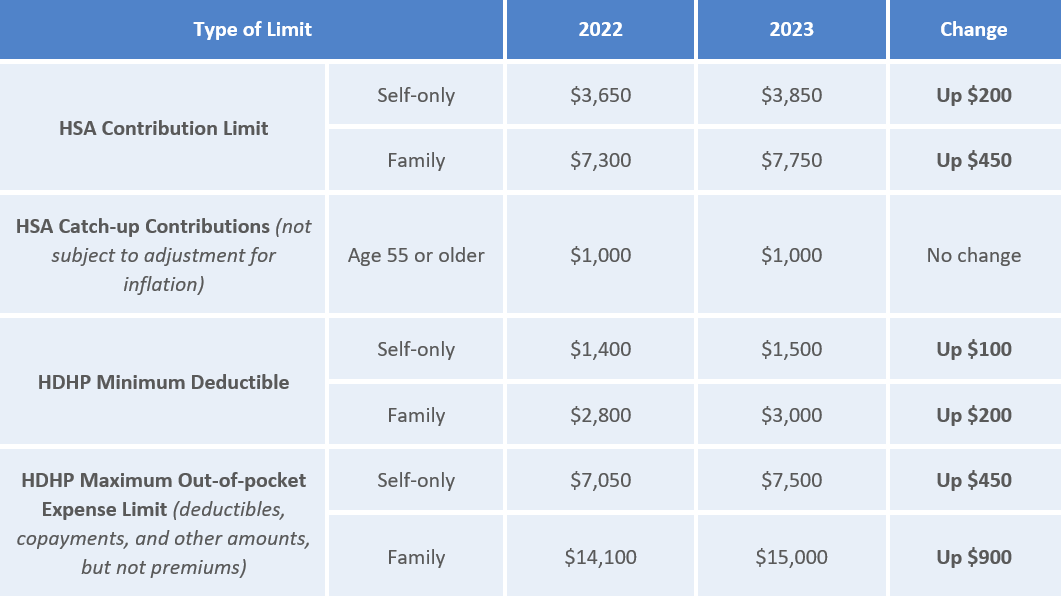

Significant HSA Contribution Limit Increase for 2025, On may 16, 2025 the internal revenue service announced the hsa contribution limits for 2025. Annual hsa contribution for participants aged 55 and older :

Hsa Contributions 2025 Ardys Winnah, Hsa contribution limits for 2025 are $4,150 for singles and $8,300 for families. The new 2025 hsa contribution limit is $4,150 if you are single—a 7.8% increase from the maximum contribution limit of $3,850 in 2025.

Irs Limit 2025 Liuka Rosalynd, The maximum amount of money you can put in an hsa in 2025 will be $4,150 for individuals and $8,300 for families. For the 2025 tax year, you can contribute up to $3,850 to an hsa if you have an eligible hdhp and are the only one on it.

2025 Tax Contribution Limits Avie Margit, The 2025 hsa contribution limit for families is $8,300, a 7.1% increase from the 2025 limit of $7,750. Contribution limit if age 55 or older:

.png)

Must Know Roth Ira Max Contribution 2025 Ideas 2025 GDS, For hsa users aged 55 and older, you can contribute an extra. Hsa members can contribute up to the annual maximum amount that is set by the irs.

HSA/HDHP Contribution Limits Increase for 2025, (people 55 and older can stash away an. Maximum employer contributions for excepted benefits: